Uni-Variate Forecasting

- Overview

- Architecture

- Methodology

- Models

- Results

Overview

What is Uni-Variate Forecasting?

Uni-Variate Forecasting predicts future values for a single time-series variable based on historical patterns. Our system combines multiple AI algorithms with automated model selection to deliver accurate forecasting solutions for business planning and decision-making.

Key Capabilities

Supervised Agentic Modelliing (SAM) for AI-Powered Model Selection

- Automatic Analysis: System analyzes your time series data to identify patterns and characteristics

- Intelligent Selection: AI chooses optimal models from 15+ available algorithms based on data properties

- Multi-Model Approach: Combines multiple forecasting methods for improved accuracy and reliability

Advanced Forecasting Algorithms

- Statistical Models: ARIMA, SARIMA, Exponential Smoothing, Theta, TBATS

- Neural Networks: N-HiTS, TFT, GRU, TCN, NBEATS, Informer

- Machine Learning: XGBoost for pattern recognition

- Specialized Models: Prophet algorithm for business time series

- Simple Models: Moving averages for baseline comparisons

Data Processing

- Automated Analysis: Seasonality detection, trend analysis, and data quality assessment

- Background Processing: Non-blocking execution with status updates

- Hyperparameter Optimization: Automatic model tuning for optimal performance

Model Integrity & Reliability

Automated Quality Assurance

- Cross-Validation: Rigorous out-of-sample testing ensures reliable performance estimates

- Statistical Significance: Comprehensive validation of model accuracy and confidence intervals

- Ensemble Consensus: Multi-model agreement reduces prediction uncertainty and improves reliability

- Performance Monitoring: Real-time accuracy tracking with automatic quality alerts

Business Transparency

- Model Selection Rationale: Clear explanations of why specific algorithms were chosen for your data

- Confidence Scoring: Reliability grades (High/Medium/Low) for informed decision-making

- Uncertainty Quantification: Error bounds and prediction ranges for risk assessment

- Quality Metrics: 25+ accuracy indicators translated into business-relevant insights

Trust Through Verification:

- 99%+ Data Integrity: Comprehensive validation of input data quality and consistency

- Multi-Algorithm Verification: Independent validation across different forecasting approaches

- Business Logic Validation: Results checked against domain knowledge and business constraints

- Automated Quality Gates: Only reliable models with proven accuracy reach production use

Core Workflow

- Upload Data: Provide your time series data in CSV or Excel format

- Configure Forecast: Select variables to forecast and set time horizon

- AI Processing: System analyzes data and selects optimal models automatically

- Generate Forecast: Multiple models create predictions with confidence intervals

- Review Results: Access forecasts, charts, and performance metrics

Output Deliverables

Forecast Results

- Forecast Data: Standardized CSV with historical fit, validation, and future predictions

- Visual Analytics: Interactive charts showing actual vs predicted values with error bands

- Executive Summary: Professional PDF report with model comparisons and recommendations

- Performance Metrics: Comprehensive accuracy indicators including RMSE, MAPE, and reliability scores

Getting Started

Data Requirements

- Minimum History: Sufficient historical data for reliable statistical analysis

- Frequency: Weekly time series data

- Format: Any structured data source (CSV, Excel, Database)

- Categories: Support for multiple product/region/segment breakdowns

Quick Start Process

- Connect Your Data: Upload files or connect to databases

- Select Variables: Choose the field to forecast and any category breakdowns

- Configure Parameters: Set forecast horizon and any specific requirements

- Launch Analysis: Our AI handles model selection and execution automatically

- Review Results: Access forecasts, charts, and executive summaries

Expected Timeline

- Analysis Phase: 2-5 minutes for dataset profiling and model selection

- Execution Phase: 5-30 minutes depending on data size and selected models

- Results Delivery: Immediate access to downloadable forecasts and reports

SAM Forecasting Technical Architecture

Overview

SAM's Uni-Variate Forecasting system is built on a sophisticated enterprise architecture that combines AI-driven intelligence, scalable processing, and robust data management to deliver high-performance forecasting at scale.

System Architecture

High-Level Architecture Diagram

Core Components

1. Data Processing Layer

- File Parsing: CSV and Excel file processing with automatic time series recognition

- Data Validation: Time series format validation and business rule verification

- Feature Engineering: Lag features, rolling statistics, and trend decomposition

- Data Preparation: Missing value handling and outlier detection

2. AI Intelligence Engine

- Model Selection: AI-driven evaluation and selection of optimal forecasting models

- Data Characterization: Statistical analysis of time series properties and patterns

- Performance Prediction: Expected accuracy and processing time estimation for each model

- Ensemble Optimization: Intelligent combination of complementary forecasting approaches

3. Processing Engine

- Background Execution: Non-blocking processing with real-time status tracking

- Multi-Model Processing: Parallel execution of selected forecasting algorithms

- Hyperparameter Optimization: Automated parameter tuning using Optuna framework

- Resource Management: Dynamic CPU/GPU allocation and memory optimization

4. Business Intelligence Layer

- Result Processing: Multi-model ensemble scoring with confidence assessment

- Visual Analytics: Chart generation showing forecast trends and confidence intervals

- Report Generation: Executive PDF reports with findings and business recommendations

- Business Metrics: SPYA analysis, growth rate calculation, and stability scoring

5. Model Integrity & Quality Assurance

- Cross-Validation Engine: Rigorous out-of-sample testing and performance validation

- Consensus Scoring: Multi-algorithm agreement assessment for reliability determination

- Quality Gates: Automated checks ensuring only validated models reach production

- Business Logic Validation: Results verification against domain knowledge and constraints

- Confidence Assessment: Real-time reliability scoring and uncertainty quantification

SAM Forecasting Processing

Data Flow Architecture

Processing Pipeline

Background Processing System

Asynchronous Execution:

- Non-Blocking Operations: User interface remains responsive during forecast processing

- Status Monitoring: Real-time progress updates and processing transparency for users

- Queue Management: Efficient handling of multiple concurrent forecasting requests

- Error Recovery: Graceful handling of processing failures with automatic retry mechanisms

SAM Forecasting Methodology: How It Works

Overview

SAM's Uni-Variate Forecasting employs a sophisticated 4-phase methodology that combines advanced statistical analysis, artificial intelligence, and enterprise-grade processing to deliver highly accurate, automated forecasts.

1. Intelligent Dataset Analysis

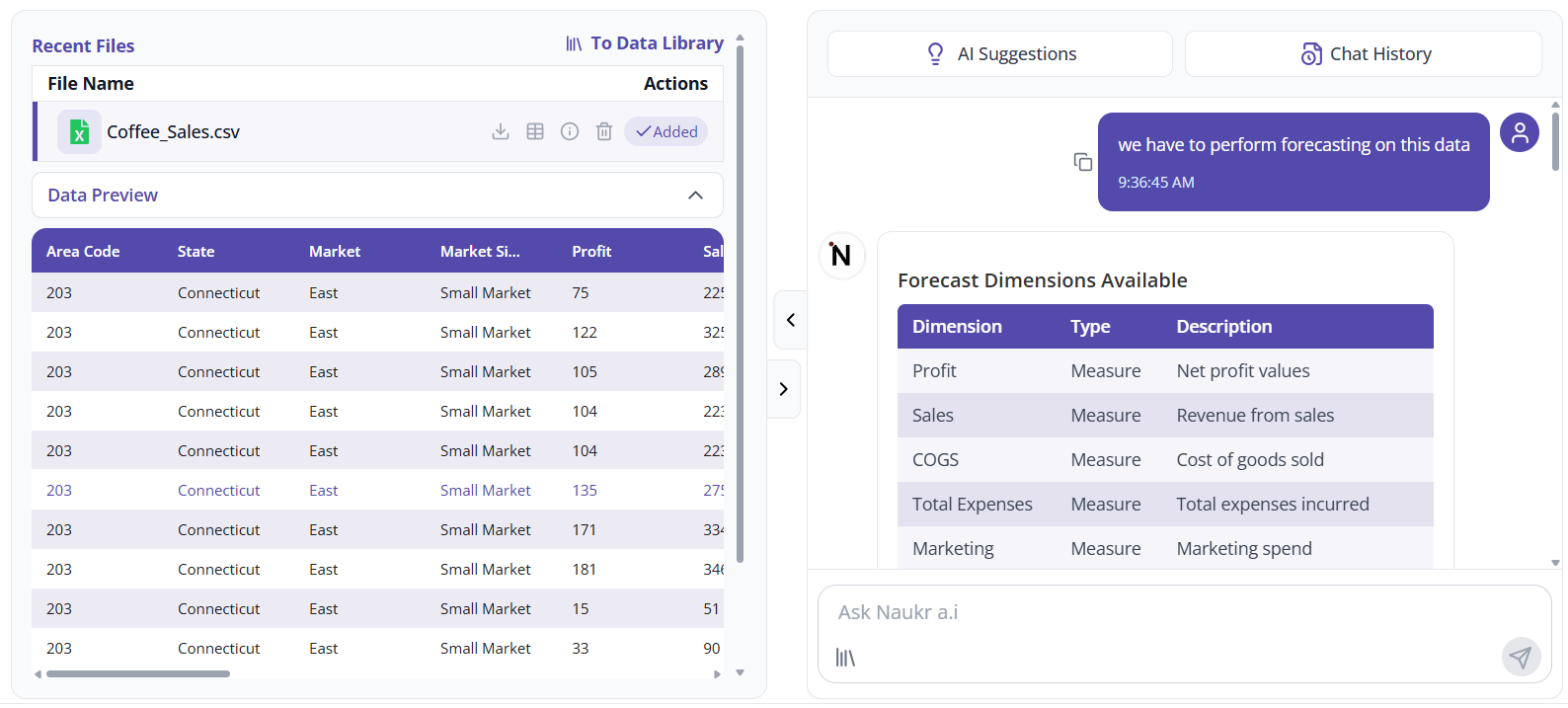

User asks SAM to run forecasting analysis through natural language conversation

User asks SAM to run forecasting analysis through natural language conversation

Comprehensive Data Profiling

Our system automatically analyzes your time series across multiple statistical dimensions to understand the underlying patterns and characteristics:

Statistical Characteristics

- Central Tendency: Mean, median, mode analysis

- Variability: Standard deviation, coefficient of variation

- Distribution: Skewness, kurtosis, normality assessment

- Data Quality: Missing values, zero counts, sparsity analysis

Time Series Properties

- Stationarity Testing: Augmented Dickey-Fuller test to determine if data needs differencing

- Seasonality Detection: Multi-period analysis (52, 26, 12, 4 weeks) with strength measurement

- Trend Analysis: Linear regression slope calculation with direction and magnitude

- Residual Analysis: Error pattern identification and strength assessment

Data Complexity Assessment

- Outlier Detection: IQR-based anomaly identification with percentage calculation

- Volatility Analysis: Coefficient of variation for stability assessment

- Size Evaluation: Large vs small dataset determination for algorithm selection

- Sparsity Measurement: Zero-value frequency for model suitability

Advanced Pattern Recognition

Example Analysis Results:

• Seasonality Strength: 0.65 (Strong seasonal pattern detected)

• Trend Direction: Increasing (3.2% monthly growth)

• Stationarity: Non-stationary (requires differencing)

• Data Quality: 98.5% complete, 2.3% outliers

• Volatility: Moderate (CV = 0.45)

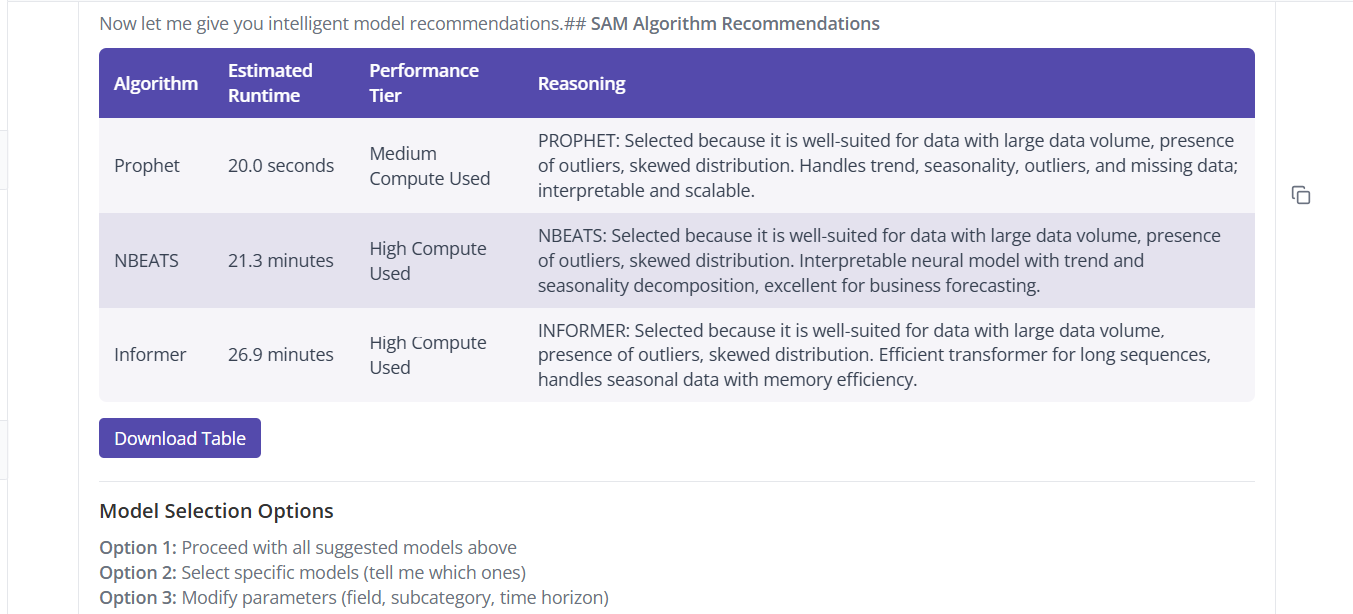

2. AI-Powered Model Selection

SAM provides intelligent model recommendations with detailed explanations of why specific algorithms were selected

SAM provides intelligent model recommendations with detailed explanations of why specific algorithms were selected

Intelligent Scoring Algorithm

Each available forecasting model receives a suitability score (0-10) based on dataset characteristics:

Model-Specific Evaluation Criteria

- Data Size Requirements: Minimum observations needed for reliable results

- Stationarity Preferences: Whether model handles non-stationary data effectively

- Seasonality Capabilities: Ability to capture and forecast seasonal patterns

- Trend Handling: Effectiveness with increasing/decreasing/stable trends

- Outlier Robustness: Performance degradation with anomalous data points

- Computational Complexity: Processing time vs accuracy trade-offs

Smart Selection Process

Step 1: Suitability Scoring

Example Model Scores:

• SARIMA: 8.5/10 (High seasonality + trend handling)

• Prophet: 8.2/10 (Robust to outliers + flexible seasonality)

• N-HiTS: 7.8/10 (Large dataset + neural network advantages)

• ARIMA: 6.5/10 (Good trend handling, no seasonality)

• Exp Smoothing: 7.2/10 (Balanced performance + speed)

Step 2: Diversity Optimization

Our system ensures balanced model selection across different categories:

- Statistical Models: ARIMA, SARIMA, Exponential Smoothing

- Neural Networks: N-HiTS, TFT, GRU, TCN

- Advanced Models: Prophet, TBATS

- Simple Models: Moving Averages, Theta

Step 3: Adaptive Selection

The number of models selected adapts to dataset characteristics:

- Small Datasets (1-2 categories): 2-3 high-quality models

- Medium Datasets (3-5 categories): 3-4 diverse models

- Large Datasets (5+ categories): 4-5 comprehensive models

3. Advanced Model Processing

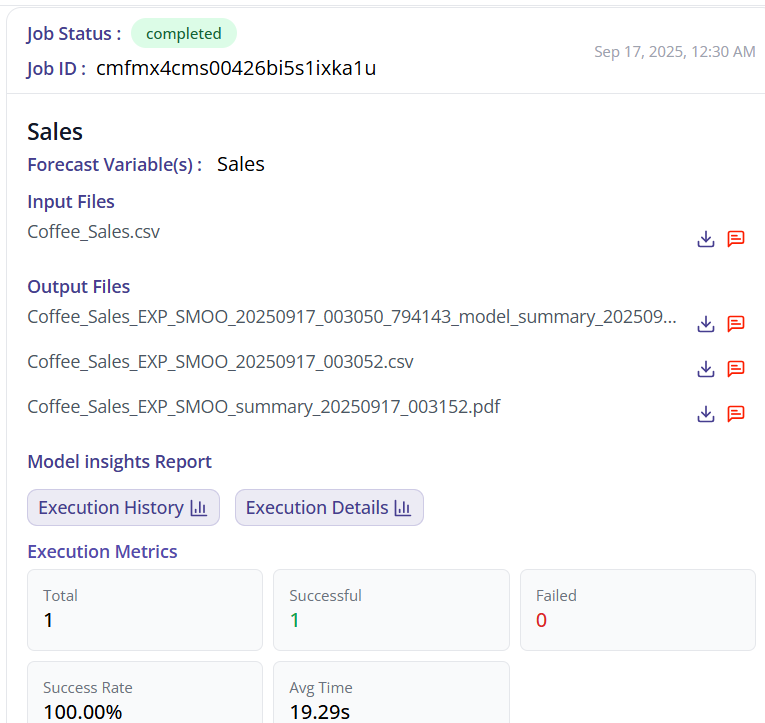

Job run page displaying real-time model execution progress with status updates and processing transparency

Hyperparameter Optimization

Each model undergoes automated tuning using the Optuna framework:

ARIMA/SARIMA Models

- Parameter Space: p (0-5), d (0-2), q (0-5) combinations

- Optimization Trials: 50 iterations with 5-minute timeout

- Selection Criteria: AIC minimization for statistical significance

- Validation Method: In-sample fit quality assessment

Neural Network Models

- Architecture Tuning: Hidden layer sizes, dropout rates, learning rates

- Training Optimization: Early stopping, batch size adaptation

- GPU Acceleration: CUDA utilization for faster computation

- Cross-Validation: Time series split validation for robustness

Prophet Models

- Seasonality Components: Weekly, yearly pattern strength

- Trend Flexibility: Changepoint detection sensitivity

- Holiday Effects: Automatic holiday impact inclusion

- Uncertainty Intervals: Bayesian posterior sampling

4. Comprehensive Result Generation

Advanced Metrics Calculation

Accuracy Metrics

- RMSE (Root Mean Square Error): Overall prediction accuracy

- MAPE (Mean Absolute Percentage Error): Percentage-based error measurement

- Reliability Score: Confidence-adjusted accuracy (0-100 scale)

- Accuracy Grade: Simplified rating (Excellent/Good/Fair/Poor)

Business Intelligence Metrics

- Growth Analysis: Historical vs forecast percentage changes

- Trend Direction: Increasing/Decreasing/Stable classification

- SPYA Comparisons: Same Period Year Ago analysis for seasonality

- Forecast Stability: Consistency measurement across prediction horizon

Confidence Assessment

- Confidence Levels: High/Medium/Low reliability classification

- Error Coefficients: Statistical uncertainty quantification

- Forecast Ranges: Upper and lower prediction bounds

Multi-Format Output Generation

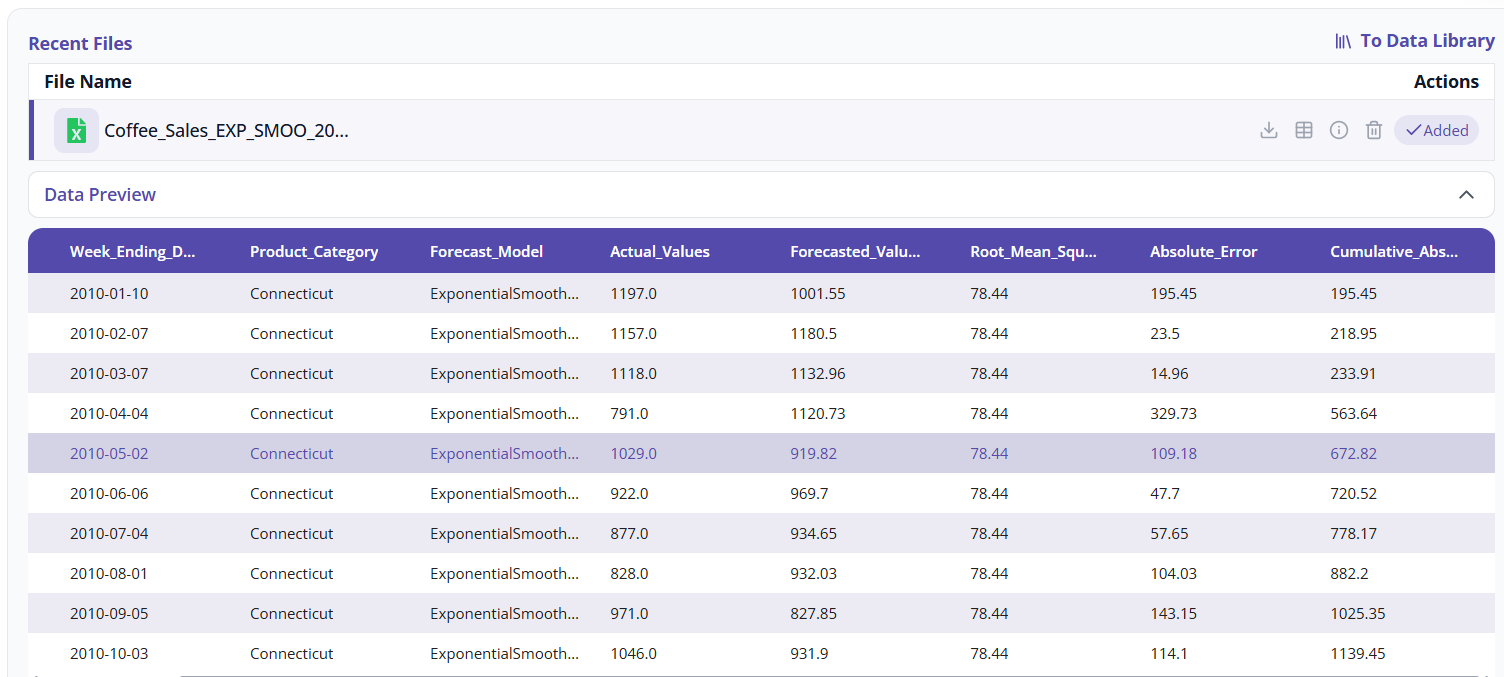

Standardized Data Export

9-column CSV format with complete forecast details:

Week | Week_Ending_Date | Product_Category | Forecast_Model |

Actual_Values | Forecasted_Values | Root_Mean_Square_Error |

Absolute_Error | Cumulative_Absolute_Error

Visual Analytics

- Interactive Charts: Actual vs predicted with error visualization

- Model Comparisons: Side-by-side performance analysis

- Trend Visualization: Long-term pattern identification

- Confidence Bands: Uncertainty representation

Executive Reporting

- PDF Summary: Professional multi-page report with model rankings

- Performance Dashboard: Key metrics visualization

- Business Insights: Growth projections and trend analysis

- Recommendation Engine: Best model identification with rationale

5. AI-Powered Business Intelligence

Revolutionary Integration: SAM combines forecasting accuracy with GPT-4 intelligence to deliver not just predictions, but strategic insights, executive summaries, and actionable business recommendations.

Why AI Integration Matters

- Technical Translation: Statistical metrics become clear business insights

- Strategic Context: Forecasts connected to business implications

- Executive Communication: Results formatted for leadership consumption

- Actionable Guidance: Specific recommendations for operations and strategy

- Risk Intelligence: Automated uncertainty analysis with business context

Azure OpenAI Integration

Enterprise-Grade AI Partnership

- Enterprise Security: Business-grade data protection and compliance

- Scalable Performance: Multiple simultaneous analyses

- Consistent Quality: Professional-grade content generation

- Cost Optimization: Efficient token usage and intelligent caching

AI Processing Pipeline

Forecast Results + Model Metrics + Business Context

↓

Data Contextualization

↓

Business Intelligence Generation

↓

Azure OpenAI GPT-4

↓

Professional Business Intelligence Output

Quality Assurance & Validation

Automated Quality Checks

- Data Integrity: Missing value handling, outlier treatment

- Model Convergence: Training stability verification

- Result Validation: Output range and trend reasonableness

- Performance Benchmarks: Historical accuracy tracking

Error Handling & Recovery

- Graceful Degradation: Fallback to alternative models if primary fails

- Partial Results: Delivery of available forecasts even with some model failures

- Status Transparency: Clear communication of any processing issues

- Recovery Options: Automatic retry mechanisms for transient failures

SAM Forecasting Models: Complete Catalog

Overview

SAM (Supervised Agentic Modelling) provides access to 12+ state-of-the-art forecasting algorithms, ranging from traditional statistical methods to cutting-edge neural networks. Our AI system automatically selects the optimal combination based on your data characteristics, ensuring maximum accuracy and reliability.

Model Categories

Statistical Models - Proven & Reliable

Traditional time series methods with decades of validation in business applications.

Neural Networks - Advanced & Adaptive

Modern deep learning approaches that excel with complex patterns and large datasets.

Specialized Models - Purpose-Built

Algorithms designed for specific use cases like seasonal business data or trend analysis.

Simple Models - Fast & Interpretable

Straightforward approaches ideal for baseline comparisons and quick insights.

Statistical Models

ARIMA (AutoRegressive Integrated Moving Average)

Best For: Data with clear trends, no seasonal patterns

- Strengths: Excellent trend modeling, statistical rigor, interpretable parameters

- Data Requirements: Minimum 50 observations, works with non-stationary data

- Processing Time: Medium (2-5 minutes for optimization)

- Use Cases: Revenue forecasting, economic indicators, non-seasonal business metrics

SARIMA (Seasonal ARIMA)

Best For: Data with both trends and seasonal patterns

- Strengths: Handles complex seasonality, robust trend modeling, statistical foundation

- Data Requirements: Minimum 100 observations, prefers multiple seasonal cycles

- Processing Time: High (5-15 minutes for optimization)

- Use Cases: Retail sales, seasonal demand, weekly/monthly business cycles

Exponential Smoothing

Best For: Stable data with moderate seasonality, robust to outliers

- Strengths: Outlier resistant, handles missing data well, fast execution

- Data Requirements: Minimum 30 observations, works with sparse data

- Processing Time: Low (1-2 minutes)

- Use Cases: Inventory planning, stable product demand, operational metrics

Theta Model

Best For: Simple trend patterns, benchmark comparisons

- Strengths: Simple and fast, good baseline performance, minimal parameters

- Data Requirements: Minimum 20 observations

- Processing Time: Very Low (<1 minute)

- Use Cases: Quick forecasts, baseline comparisons, simple trend analysis

Neural Network Models

N-HiTS (Neural Hierarchical Interpolation for Time Series)

Best For: Large datasets, complex patterns, long-term forecasting

- Strengths: Excellent accuracy on large datasets, handles multiple seasonalities

- Data Requirements: Minimum 200 observations, benefits from GPU acceleration

- Processing Time: Medium-High (3-10 minutes with GPU)

- Use Cases: Demand forecasting, financial markets, large-scale operations

TFT (Temporal Fusion Transformer)

Best For: Complex temporal patterns, multi-scale seasonality

- Strengths: State-of-the-art accuracy, attention mechanism, interpretability

- Data Requirements: Minimum 300 observations, GPU recommended

- Processing Time: High (5-20 minutes with GPU)

- Use Cases: Financial forecasting, complex business cycles, research applications

GRU (Gated Recurrent Unit)

Best For: Sequential patterns, moderate computational requirements

- Strengths: Good balance of accuracy and speed, handles sequences well

- Data Requirements: Minimum 100 observations, GPU acceleration available

- Processing Time: Medium (2-8 minutes with GPU)

- Use Cases: Sales forecasting, user behavior, operational planning

TCN (Temporal Convolutional Network)

Best For: Long-term dependencies, parallel processing

- Strengths: Fast training, captures long-term patterns, parallelizable

- Data Requirements: Minimum 150 observations, GPU acceleration beneficial

- Processing Time: Medium (2-6 minutes with GPU)

- Use Cases: Long-term planning, capacity forecasting, strategic analysis

Specialized Models

Prophet (Facebook's Algorithm)

Best For: Business data with holidays, missing values, outliers

- Strengths: Robust to outliers, handles missing data, holiday effects

- Data Requirements: Minimum 100 observations, flexible with data quality

- Processing Time: Medium (2-5 minutes)

- Use Cases: Business metrics, user engagement, marketing analytics

TBATS (Trigonometric, Box-Cox, ARMA, Trend, Seasonal)

Best For: Complex seasonality, multiple seasonal periods

- Strengths: Handles complex seasonality, automatic transformation selection

- Data Requirements: Minimum 200 observations, multiple seasonal cycles

- Processing Time: High (10-30 minutes)

- Use Cases: Complex seasonal business, multiple time cycles, detailed analysis

Simple Models

Moving Averages (4, 8, 13 weeks)

Best For: Baseline forecasts, trend smoothing, quick insights

- Strengths: Fast execution, easy interpretation, stable predictions

- Data Requirements: Minimum data equal to window size

- Processing Time: Very Low (less than 30 seconds)

- Use Cases: Baseline comparisons, trend analysis, quick estimates

Model Selection Guide

Automatic Selection Criteria

Our AI system selects models based on these data characteristics:

For Seasonal Data (Strong Patterns)

- SARIMA - Statistical rigor with seasonality

- Prophet - Robust handling of business seasonality

- TFT - Maximum accuracy for complex patterns

- Exponential Smoothing - Fast, reliable seasonal modeling

For Trending Data (Growth/Decline)

- ARIMA - Classic trend modeling

- Prophet - Flexible trend handling

- N-HiTS - Neural network trend capture

- GRU - Sequential trend modeling

For Large Datasets (1000+ observations)

- N-HiTS - Designed for large-scale data

- TFT - Transformer architecture benefits

- TCN - Parallel processing advantages

- Prophet - Scalable performance

For Noisy/Outlier Data

- Prophet - Robust to anomalies

- Exponential Smoothing - Outlier resistant

- GRU - Neural robustness

- Moving Averages - Natural smoothing

For Fast Results (< 2 minutes)

- Theta - Minimal processing time

- Moving Averages - Instant results

- Exponential Smoothing - Quick optimization

- ARIMA - Fast convergence

Performance Matrix

| Model | Accuracy | Speed | Complexity | Seasonality | Trend | Outlier Robust |

|---|---|---|---|---|---|---|

| ARIMA | High | Medium | Medium | ❌ | ✅ | ❌ |

| SARIMA | High | Low | High | ✅ | ✅ | ❌ |

| Exp Smoothing | Medium | High | Low | ✅ | ✅ | ✅ |

| Prophet | High | Medium | Medium | ✅ | ✅ | ✅ |

| N-HiTS | Very High | Medium | High | ✅ | ✅ | Medium |

| TFT | Very High | Low | Very High | ✅ | ✅ | Medium |

| GRU | High | Medium | High | Medium | ✅ | Medium |

| TCN | High | High | High | Medium | ✅ | Medium |

| Theta | Medium | Very High | Very Low | ❌ | ✅ | ❌ |

| Moving Avg | Low | Very High | Very Low | ❌ | Medium | ✅ |

How SAM Selects Models

Intelligent Model Selection Process

SAM automatically chooses the best forecasting models for your data through a 3-step AI-driven process:

Step 1: Data Analysis

Our system analyzes your time series across 25+ characteristics:

- Seasonality: Detects weekly, monthly, quarterly patterns

- Trends: Identifies growth, decline, or stability

- Data Quality: Assesses completeness and outliers

- Volatility: Measures data stability and variability

- Size & Complexity: Evaluates dataset characteristics

Step 2: Model Scoring

Each of the 12+ available models receives a suitability score (0-10):

- Statistical Models (ARIMA, SARIMA): Best for clear trends and seasonal patterns

- Neural Networks (N-HiTS, TFT): Optimal for large, complex datasets

- Specialized Models (Prophet): Ideal for business data with holidays/outliers

- Simple Models (Moving Averages): Perfect for quick, stable forecasts

Step 3: Smart Selection

The AI doesn't just pick the highest scores - it ensures diversity:

- Balanced Portfolio: Combines different model types for robustness

- Optimal Count: Selects 2-5 models based on data complexity

- Performance Priority: Balances accuracy with processing speed

- Category Limits: Prevents over-reliance on any single approach

What You See

When forecasting starts, you'll receive:

- Selected Models: "AI chose Prophet, SARIMA, and N-HiTS"

- Selection Reason: "Best for seasonal business data with growth trends"

- Expected Accuracy: "Excellent performance anticipated"

- Processing Time: "Estimated completion in 8-12 minutes"

User Control Options

While AI selection is recommended, you can:

- Specify Models: Choose exact algorithms if needed

- Set Priorities: Emphasize speed vs accuracy

- Use Presets: Industry-optimized combinations available

Understanding SAM Forecasting Results

Overview

SAM provides comprehensive forecasting outputs designed to support both technical analysis and business decision-making. This guide explains how to interpret all 25+ metrics and use them effectively for strategic planning.

Primary Outputs

1. Forecast Data (CSV Export)

Professional CSV output with forecast data, accuracy metrics, and performance indicators for business analysis

Professional CSV output with forecast data, accuracy metrics, and performance indicators for business analysis

Standardized 9-Column Format:

Week | Week_Ending_Date | Product_Category | Forecast_Model |

Actual_Values | Forecasted_Values | Root_Mean_Square_Error |

Absolute_Error | Cumulative_Absolute_Error

Key Features:

- Historical Fit: Shows how well models captured past patterns

- Validation Period: Out-of-sample accuracy assessment

- Future Forecasts: Predictions for your specified horizon

- Multiple Models: Compare performance across different algorithms

- Category Breakdown: Separate forecasts for each product/region/segment

2. Visual Analytics (Interactive Charts)

Chart Components:

- Actual vs Predicted Lines: Visual accuracy assessment

- Error Bands: Uncertainty visualization with confidence intervals

- Trend Indicators: Growth direction and magnitude

- Seasonal Patterns: Cyclical behavior identification

- Model Comparisons: Side-by-side performance visualization

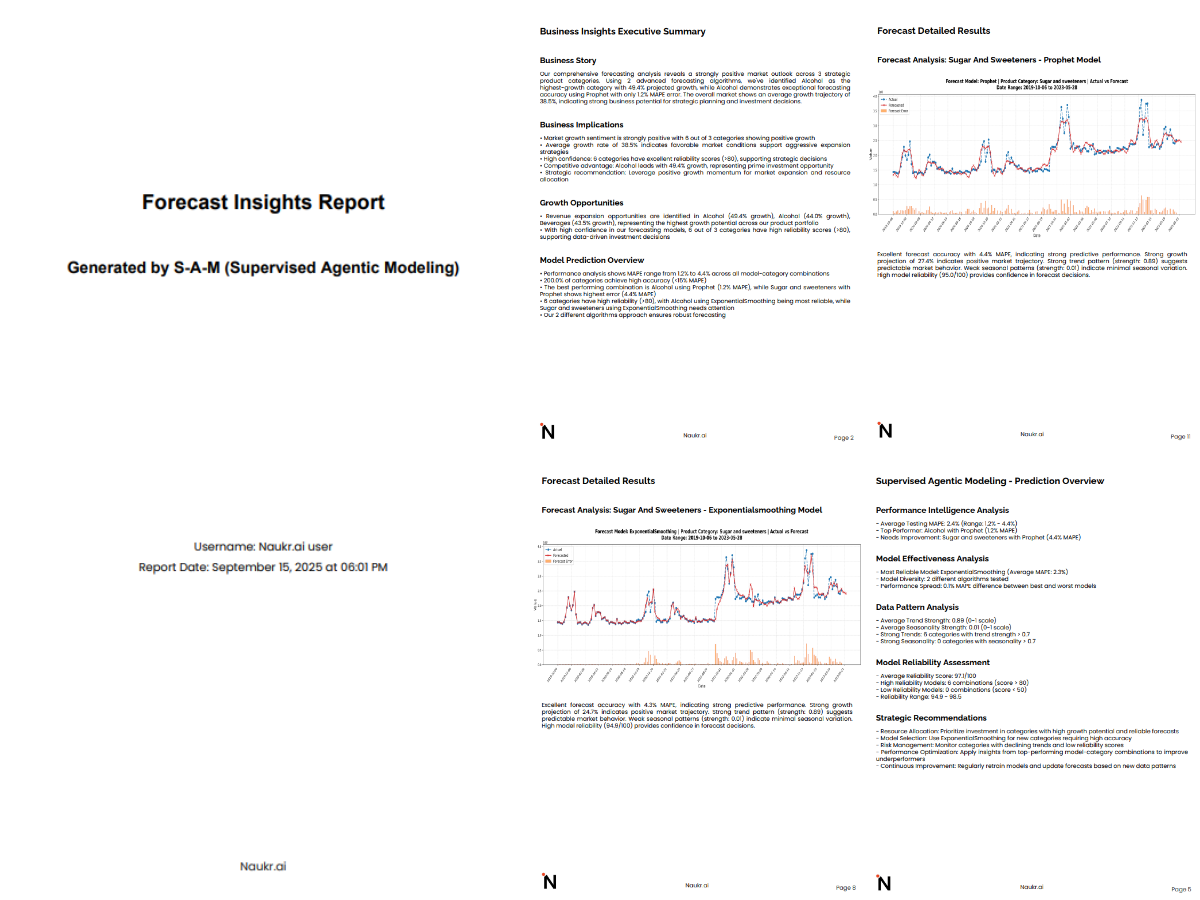

3. Executive Summary (PDF Report)

Complete executive PDF report with model performance, visual analytics, business insights, and strategic recommendations

Complete executive PDF report with model performance, visual analytics, business insights, and strategic recommendations

Multi-Page Professional Report:

- Title Page: Project overview and generation date

- Performance Summary: Model rankings and recommendations

- Visual Forecasts: All charts included with captions

- Business Insights: Key findings and strategic implications

- Technical Glossary: Metric definitions and interpretations

Understanding Accuracy Metrics

Primary Accuracy Indicators

RMSE (Root Mean Square Error)

What it measures: Overall prediction accuracy in original units

- Excellent: < 5% of data mean

- Good: 5-15% of data mean

- Fair: 15-30% of data mean

- Poor: > 30% of data mean

Business Interpretation:

Example: Sales RMSE = 1,200 units

• If average sales = 10,000 units → 12% error (Good)

• If average sales = 50,000 units → 2.4% error (Excellent)

MAPE (Mean Absolute Percentage Error)

What it measures: Average percentage error across all predictions

- Excellent: < 5%

- Good: 5-10%

- Fair: 10-20%

- Poor: > 20%

Business Interpretation:

MAPE = 8.5% means:

• Forecasts are typically within 8.5% of actual values

• For $100K revenue forecast, expect ±$8.5K accuracy

• Suitable for budgeting and planning purposes

Simplified Quality Ratings

Accuracy Assessment

Our AI automatically grades model performance:

- Excellent (MAPE < 5%): High confidence for strategic decisions

- Good (MAPE 5-10%): Reliable for operational planning

- Fair (MAPE 10-20%): Useful for directional guidance

- Poor (MAPE > 20%): Consider additional data or different approach

Confidence Levels

Risk assessment for forecast reliability:

- High: Low variability, consistent patterns, strong model fit

- Medium: Moderate uncertainty, acceptable for most planning

- Low: High variability, use with caution, consider ranges

Business Intelligence Metrics

Growth and Trend Analysis

Growth Rate Percentage

Calculation: (Forecast Mean - Historical Mean) / Historical Mean × 100 Business Use:

- Positive Growth: Expansion planning, resource allocation

- Negative Growth: Cost management, efficiency improvements

- Stable Growth: Maintenance mode, operational optimization

Forecast Trend Direction

- Increasing: Upward trajectory, growth opportunities

- Decreasing: Declining pattern, intervention needed

- Stable: Consistent performance, predictable planning

Historical vs Forecast Values

Compare past performance with future projections:

Historical Mean: 45,000 units/week

Forecast Mean: 52,000 units/week

Growth Rate: +15.6% (Strong growth expected)

SPYA Analysis (Same Period Year Ago)

SPYA Absolute Change

What it measures: Total difference between forecasted and same period last year Business Value: Seasonal comparison for business cycles

Example: Q4 forecast vs Q4 last year

SPYA Absolute Change: +125,000 units

Indicates stronger Q4 performance expected

SPYA Percentage Change

What it measures: Percentage growth vs same period last year Strategic Insights:

- Positive: Year-over-year growth

- Negative: Year-over-year decline

- Seasonal: Expected for cyclical businesses

Advanced Quality Metrics

Reliability and Confidence

Model Reliability Score (0-100)

Calculation: Accuracy-adjusted confidence measure

- 90-100: Extremely reliable, suitable for critical decisions

- 70-89: Good reliability, appropriate for most planning

- 50-69: Moderate reliability, use with additional validation

- < 50: Low reliability, consider alternative approaches

Forecast Stability Score

What it measures: Consistency of predictions across forecast horizon

- High Stability: Smooth, predictable forecasts

- Low Stability: Volatile predictions, higher uncertainty

- Business Impact: Planning complexity and risk assessment

Error Coefficient of Variation

Technical Measure: Standard deviation of errors / mean of actuals Business Interpretation:

- < 0.05: Very consistent performance

- 0.05-0.10: Acceptable variability

- > 0.10: High variability, consider forecast ranges

Data Quality Indicators

Trend Strength

Scale: 0-1, where higher values indicate stronger trends

- > 0.7: Strong trend, reliable for extrapolation

- 0.3-0.7: Moderate trend, good for medium-term planning

- < 0.3: Weak trend, focus on short-term forecasts

Seasonality Strength

Scale: 0-1, where higher values indicate stronger seasonal patterns

- > 0.7: Strong seasonality, plan for seasonal variations

- 0.3-0.7: Moderate seasonality, consider seasonal factors

- < 0.3: Weak seasonality, focus on trend and level

Model Performance Comparison

Model Rankings Table

Our executive summary includes a comprehensive comparison:

| Model | Accuracy Grade | MAPE | Reliability Score | Best Use Case |

|---|---|---|---|---|

| Prophet | Excellent | 4.2% | 94 | Strategic Planning |

| SARIMA | Good | 8.1% | 87 | Operational Forecasting |

| N-HiTS | Excellent | 3.8% | 96 | High-Stakes Decisions |

Recommendation Engine

Best Model Selection: Our AI recommends the optimal model based on:

- Accuracy Performance: Out-of-sample validation results

- Business Context: Forecast horizon and use case requirements

- Data Characteristics: Trend, seasonality, and quality factors

- Computational Efficiency: Processing time and resource requirements

Risk Assessment Framework

High Confidence Scenarios (Use forecasts directly)

- Accuracy Grade: Excellent

- Confidence Level: High

- MAPE < 5%

- Reliability Score > 90

Medium Confidence Scenarios (Use ranges)

- Accuracy Grade: Good/Fair

- Confidence Level: Medium

- Consider forecast ± error bounds

- Develop contingency plans

Low Confidence Scenarios (Directional guidance only)

- Accuracy Grade: Fair/Poor

- Confidence Level: Low

- Focus on trend direction

- Frequent re-forecasting recommended

AI-Generated Insights

Executive Summaries

What you get: Business-focused analysis for each forecast including:

- Performance assessment in business terms

- Key trends and growth opportunities

- Comparison to previous periods

- Strategic implications

Example:

"Product A shows 18% YoY growth with high reliability (87%). Clear seasonal patterns indicate March peak demand. Significant acceleration from Q4's 8% growth suggests successful market strategies requiring capacity validation."

Actionable Recommendations

Categories:

- Inventory Management: Stock level recommendations

- Marketing Strategy: Timing and targeting suggestions

- Capacity Planning: Resource allocation guidance

- Risk Management: Issue mitigation strategies

Interpreting Forecast Charts

Visual Elements

- Blue Line (Actual): Historical performance data

- Red Line (Forecast): Model predictions

- Orange Shading: Absolute error magnitude

- Confidence Bands: Upper and lower prediction bounds

Pattern Recognition

- Seasonal Peaks: Regular high/low cycles

- Trend Lines: Overall growth or decline direction

- Volatility: Consistency vs variability in patterns

- Break Points: Significant pattern changes

Business Insights

- Peak Planning: Prepare for seasonal demand spikes

- Trough Management: Optimize during low-demand periods

- Growth Trajectory: Long-term expansion or contraction

- Pattern Changes: Market shifts or business evolution

Common Pitfalls to Avoid

1. Over-Relying on Low Confidence Forecasts

- Problem: Major decisions on reliability scores under 70%

- Solution: Use for directional guidance only

2. Ignoring Seasonal Patterns

- Problem: Not accounting for seasonality

- Solution: Review seasonality strength, adjust plans

3. Misinterpreting Confidence Intervals

- Problem: Treating ranges as exact predictions

- Solution: Use for scenario planning

4. Not Validating Against Business Context

- Problem: Accepting forecasts misaligned with business changes

- Solution: Validate AI insights against business knowledge